Perché hai bisogno di un'APIper TicketBAI?

TicketBAI (TBAI) è la normativa fiscale in vigore nei Paesi Baschi e riguarda le aziende di ogni settore e dimensione con sede fiscale nelle provincie di Biscaglia, Álava e Guipúzcoa.

Funzionalità di SIGN ES

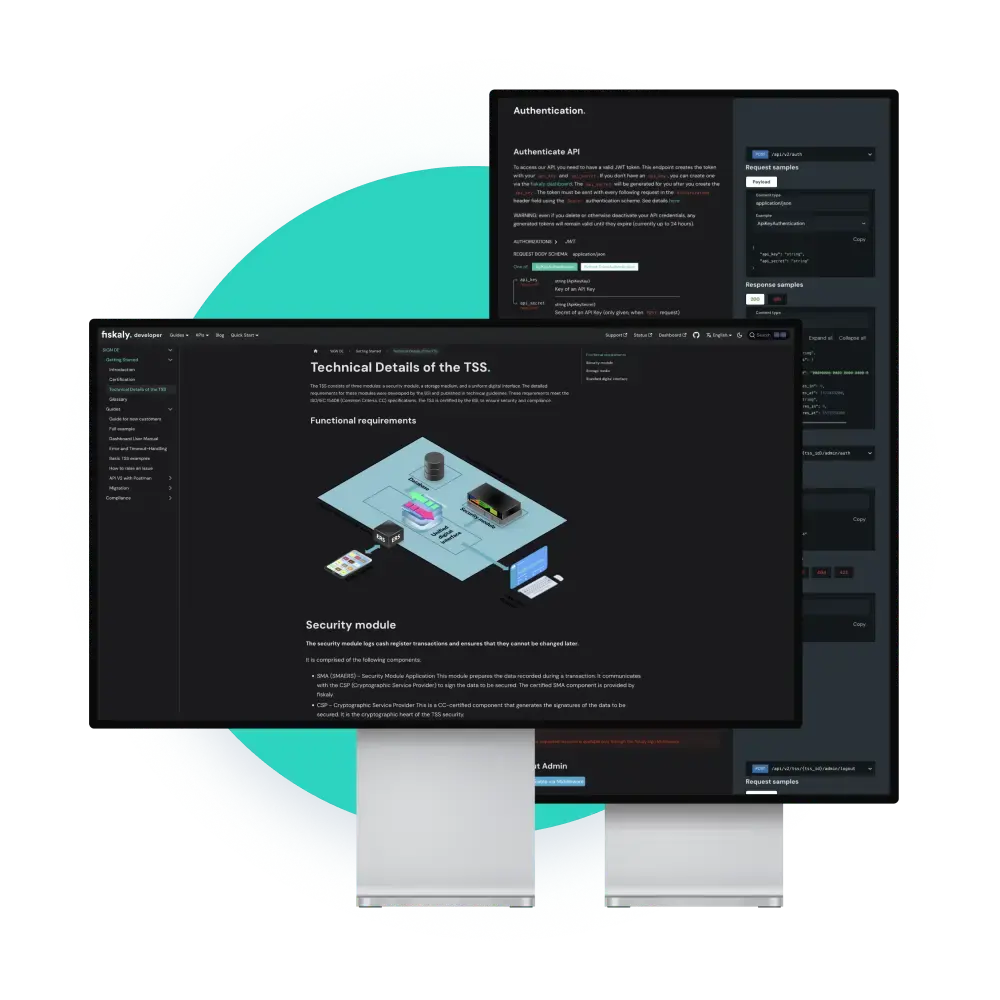

Integrando un'unica API, rispetterai automaticamente il regolamento TicketBAI, la legge antifrode (VeriFactu) e la normativa Crea y Crece (sulla fatturazione elettronica B2B).

Abbiamo sviluppato un processo di convalida per evitare che i file vengano rifiutati. Comodo e senza errori.

Firma, concatena e invia i file XML alle autorità fiscali basche in tempo reale. Confidenziale al 100%.

Filtra ed esporta le tue fatture in un solo clic tramite l'API o la dashboard SIGN.

Genera automaticamente i codici necessari su ogni fattura in conformità con le normative.

Se il tuo sistema perde temporaneamente la connessione o ha problemi di connettività, non preoccuparti! Ti aiutiamo noi.

Verifactu per fornitori di software in Spagna 2025

Anticipa la concorrenza e trasforma il rispetto delle norme fiscali in un vantaggio con una guida completa su Verifactu. Scopri in dettaglio:

- Cosa sono la Legge Antifrode e i sistemi Verifactu

- Chi è interessato e le implicazioni della legge per gli sviluppatori di software

- Come evitare le sanzioni per mancata conformità

- Requisiti tecnici e come adattare il tuo software senza difficoltà

- API Verifactu: cos'è e come integrarla nel tuo software

FAQ su TicketBAI

Ti interessa? Richiedi un primo incontro

- Siamo disponibili per rispondere a qualsiasi domanda e aiutarti a trovare la soluzione giusta per te.

- Oltre 800 aziende si affidano alle nostre soluzioni di gestione fiscale. Ti aiutiamo noi!

Ultime notizie su TicketBAI

Tutti gli articoli

Biscay extends TicketBAI implementation period to 2026