Warum brauchen Sie eineTicketBAI API?

TicketBAI (TBAI) ist die im Baskenland geltende Steuerregelung, die für Unternehmen aller Branchen und Größen mit Steuersitz in Bizkaia, Álava und Gipuzkoa obligatorisch ist.

SIGN ES Funktionen

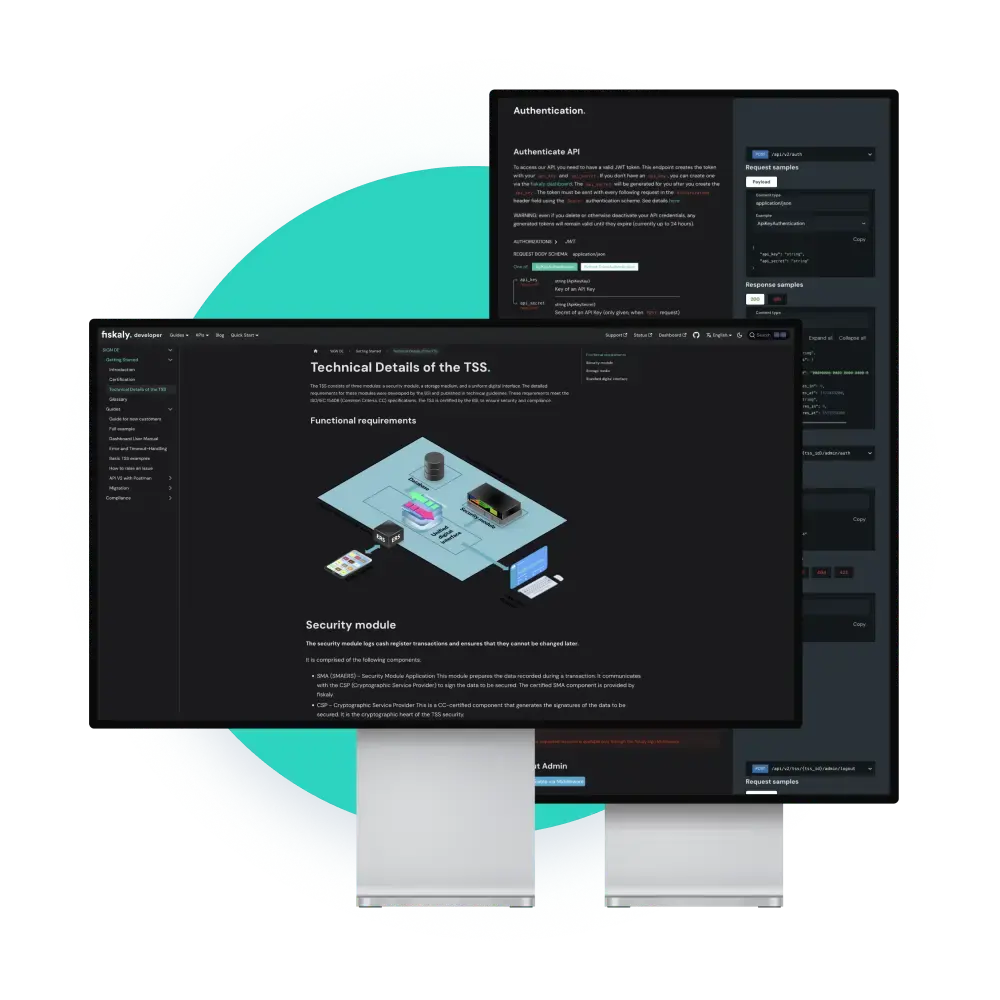

Durch die Integration einer einzigen API erfüllen Sie automatisch die Anforderungen von TicketBAI, des Betrugsbekämpfungsgesetzes (VeriFactu) und des Gesetzes Crea y Crece (elektronische B2B-Rechnung).

Wir haben ein Validierungsverfahren entwickelt, um die Ablehnung von Dateien zu verhindern und eine bequeme und fehlerfreie Nutzung zu gewährleisten.

Signieren, verketten und senden Sie die XML-Dateien in Echtzeit an die baskischen Steuerbehörden. 100% vertraulich.

Filtern und exportieren Sie Ihre Rechnungen mit nur einem Klick, sowohl über die API als auch über unser SIGN Dashboard.

Erzeugt automatisch die erforderlichen Codes auf jeder Rechnung in Übereinstimmung mit den Vorschriften.

Wenn Ihr System einen vorübergehenden Verbindungsverlust oder Probleme mit der Konnektivität hat, machen Sie sich keine Sorgen! Wir sind für Sie da.

Leitfaden herunterladen: Verifactu für Softwareanbieter in Spanien 2025

Seien Sie der Konkurrenz einen Schritt voraus und machen Sie steuerliche Konformität zum Vorteil mit einem umfassenden Leitfaden zu Verifactu. Erfahren Sie im Detail:

- Was das Betrugsbekämpfungsgesetz und die Verifactu-Systeme sind

- Wen die Gesetzgebung betrifft und welche Auswirkungen sie auf Softwareentwickler hat

- Wie Sie Strafen wegen Nichteinhaltung vermeiden können

- Technische Anforderungen und wie Sie Ihre Software nahtlos anpassen können

- Verifactu-API: Details zur API und wie man sie in seine Software integriert

TicketBAI FAQs

Interessiert? Vereinbaren Sie ein Erstgespräch

- Wir helfen Ihnen gerne bei Fragen und finden die perfekte Lösung für Sie.

- Über 800 Unternehmen vertrauen auf unsere Fiskalisierungslösungen. Sie können sich auf uns verlassen!

Aktuelles zu TicketBAI

Alle Artikel

Biskaya verlängert den Zeitraum für TicketBAI-Einführung bis 2026