Why do you need aVerifactu API?

The Anti-Fraud Law 11/2021 defines Verifactu’s technical standards. All invoicing software in Spain must comply from July 2025. With fiskaly SIGN ES, you’re compliant today, no code rewrite needed. Save time, reduce risk, and partner with a compliance expert.

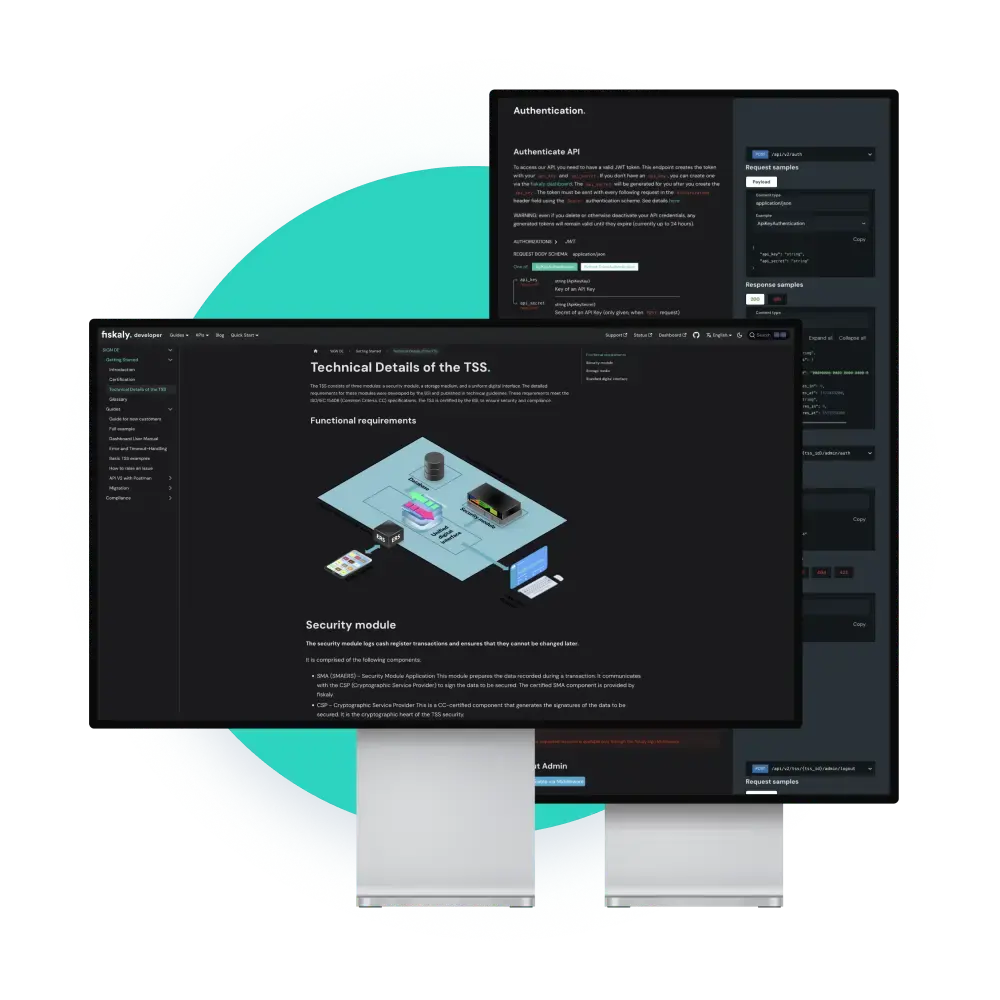

Features of fiskaly. SIGN ES Verifactu API

By integrating a single API, scale your software across regions and comply with TicketBAI, Anti-Fraud Law, and Crea y Crece Law without extra development.

fiskaly SIGN ES validates invoices before submission, avoiding Tax Agency’s rejections from the first invoice. Convenient and error-free.

Sign, chain, and send XML files to the national Tax Authorities in real time, 100% securely, even before mandatory compliance starts.

Filter and export invoices with 1 click or send them in batches using one endpoint. Lower network load, higher performance for ERPs and POS systems.

Your clients don’t need their own certificate. We handle it all via our Social Collaboration agreement with AEAT, fully secure and simplified.

If Internet goes down, your software keeps working: we detect the issue, manage the incidence, let you generate the QR, and auto-resend when reconnected, no penalties.

Try the Verifactu API for free: book a call

- We're here to simplify your company's fiscal compliance.

- Always available to help with any questions and find the perfect solution.

- Over 1,600 customers trust our fiscalization solutions. We've got you covered!

FAQ about Anti-Fraud Law and Verifactu systems

Download the guide: Verifactu for software vendors in Spain 2025

Get ahead of the competition and turn fiscal compliance into an advantage with a comprehensive guide about Verifactu. Get to learn in detail about:

- What the Antifraud Law and the Verifactu systems are

- Who is affected and the implications of the law for software developers

- How to avoid penalties for non-compliance

- Technical requirements and how to adapt your software seamlessly

- Verifactu API: what is it and how to integrate it into your software

Verifactu Highlights

All blog posts

Everything you need to know about Tax Compliance in Spain for 2025