4 most common myths about implementing digital receipts

Following the political demand to abolish the obligation to issue receipts for amounts below €30, the topic is currently being discussed intensively in the Austrian media. In the process, the potential of digital receipts has also gained increased attention.

As product manager for digital receipt by fiskaly and fiscalization expert, Stefan Kohlbacher is very familiar with the details on the topic. In this article, he clarifies some of the myths about the implementation of digital receipts that are often mentioned in public discussions.

Myth 1: Digitizing receipts is costly and time-consuming

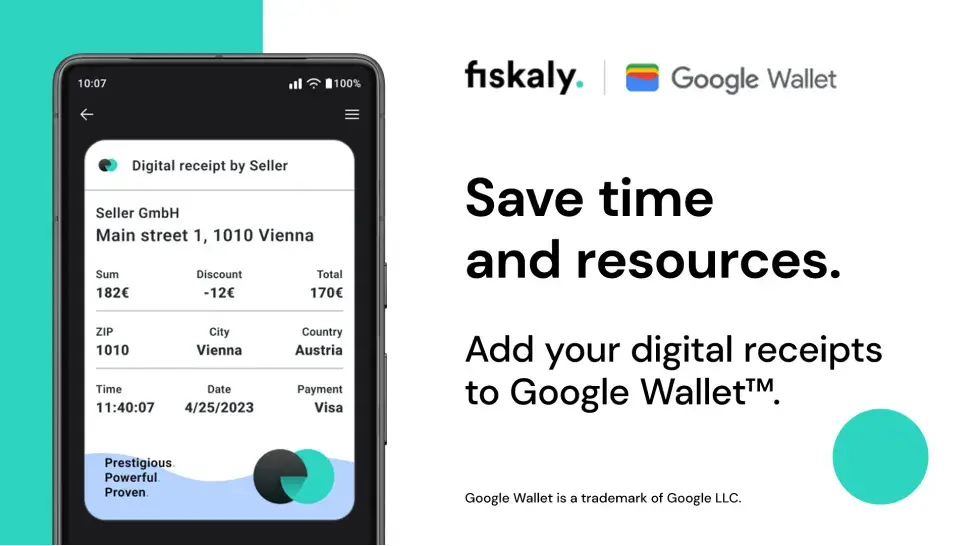

The common assumption that the introduction of digital receipts involves a high financial effort for merchants and is therefore reserved for large market players is not true. Solutions for digital receipts are not expensive. Moreover, existing investment subsidies in the area of digitization, such as those provided by Austria Wirtschaftsservice and the Vienna Business Agency, can be used. In addition, it should not be forgotten that the use of digital receipts definitely saves costs on hardware as well as in operations.

Myth 2: Customers must provide their data when using digital receipts

Completely anonymous transmission by scanning QR codes is possible every time and at a low cost. The fact that the collection and storage in connection with personal data (e.g. customer apps, etc.) brings further advantages for retailers, but also for consumers, is of course different matter.

Myth 3: Digital receipts increase waiting times at the checkout

In some industries, payment processing at the checkout would be significantly slowed down. This may be the case if personal data first has to be captured in a time-consuming manner, but not if the delivery of a digital receipt works via QR code or, even better, with direct banking integration.

Myth 4: Digital receipts are not automatically sent to the tax office

A legally compliant receipt issuing obligation within the framework of the Austrian Registrierkassensicherheitsverordnung (RKSV) is also ensured by digital receipts. It is also true that every cash register is directly connected to the Ministry of Finance via an interface, but this is only used to register the cash register and its security devices, as well as their configuration. A transmission per transaction or a receipt does not take place this way.

The proposed limit of 30 euros for the receipt issuing obligation therefore represents a challenge for all parties involved in my view: The elimination of a large volume of receipts also means the elimination of an important aspect of the previously envisaged audit cycle and can trigger a significantly higher time requirement for both the tax authorities and the merchant, as well as a potential disruption of business operations.

– Stefan Kohlbacher, Product Manager for digital receipt by fiskaly

In any case, the debate surrounding receipts remains exciting and is absolutely timely. Digital receipts are an excellent solution with many advantages, but some challenges for frictionless implementation and conversion still need to be mastered. We look forward to the dialog!