Automated cash register reporting: fast, secure & compliant

Starting in 2025, businesses are required to register their cash registers with the tax authorities. fiskaly SUBMIT DE automates this process, replacing manual reporting via the ELSTER portal. This saves time and costs while minimizing manual effort.

Why automated cash register reporting?

From 2025, businesses must comply with a new requirement: All electronic cash registers, taximeters, and odometers must be reported to the tax authorities. The process is time-consuming and error-prone—especially if reporting is done manually via ELSTER or through a tax consultant.

Your benefits with the fiskaly. SUBMIT DE

No manual ELSTER login required, no duplicate data entry.

Reports are submitted within seconds instead of minutes or hours.

More cost-effective than hiring a tax consultant.

Reduces input errors and ensures a seamless reporting process.

Suitable for both single businesses and large retail chains.

Meets all legal requirements according to §146a (4) AO.

Direct connection to your cash register system via API.

FAQ cash register reporting obligation in Germany

How the fiskaly. SUBMIT DE works

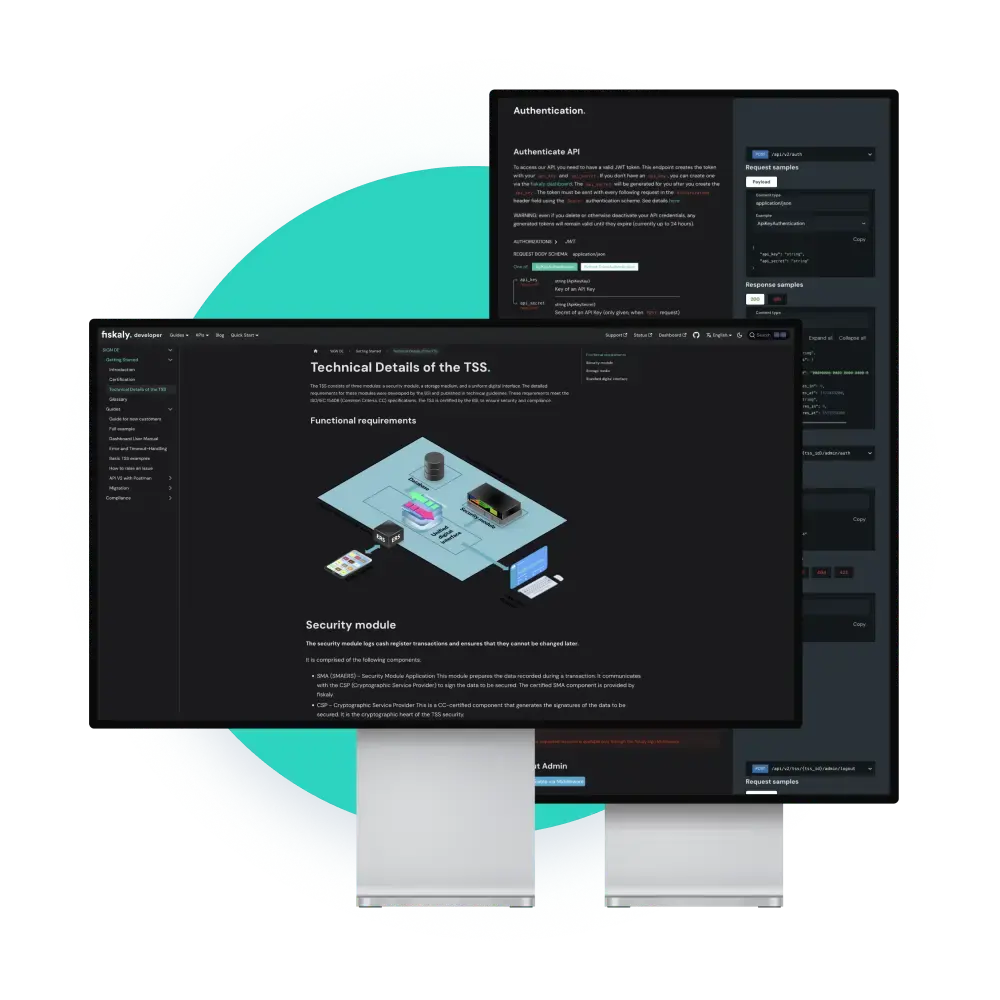

The API documentation provides all the information you need for integration and usage.

API users provide the required data.

The information is securely and fully automated to the tax authorities.

Successful registration is documented immediately.

Use the fiskaly SUBMIT DE

Simplify your cash register reporting with a cloud-based service and rely on a secure, compliant, and efficient API.

From our blog

Fiscalization in Hospitality: LINA and fiskaly Join Forces