Navigating fiscalization regulations in Europe

What is fiscalization?

Fiscalization refers to the legal framework and technical measures implemented by governments to ensure the accurate recording and reporting of financial transactions for tax purposes.

This system is designed to combat tax evasion and improve transparency in business operations by mandating the use of certified devices, software, or procedures that securely document sales data.

Fiscalization requirements vary by country but typically include

- the use of fiscal devices like cash registers or software integrated with tax authorities,

- the issuance of compliant receipts,

- and the real-time or periodic transmission of transaction data to governmental systems.

These measures help create a more secure and reliable tax ecosystem, benefiting both businesses and regulatory bodies.

What is the goal of fiscalization?

Fiscalization is the cornerstone of modern tax compliance systems, ensuring that every financial transaction is securely recorded and reported to tax authorities. At its heart, fiscalization involves implementing technology-driven measures, such as certified software, secure devices, or real-time reporting systems, to safeguard the integrity of financial data.

Fiscalization combats tax fraud

One of the primary drivers of fiscalization is to reduce tax evasion, particularly in cash-heavy sectors. By mandating secure and tamper-proof transaction recording, fiscalization ensures that all taxable revenues are accurately reported.

Fiscalization increases transparency

Fiscalization systems enhance visibility for tax authorities, enabling real-time monitoring or prompt access to transaction data. This increased transparency fosters greater trust in the system and ensures accountability across all market participants.

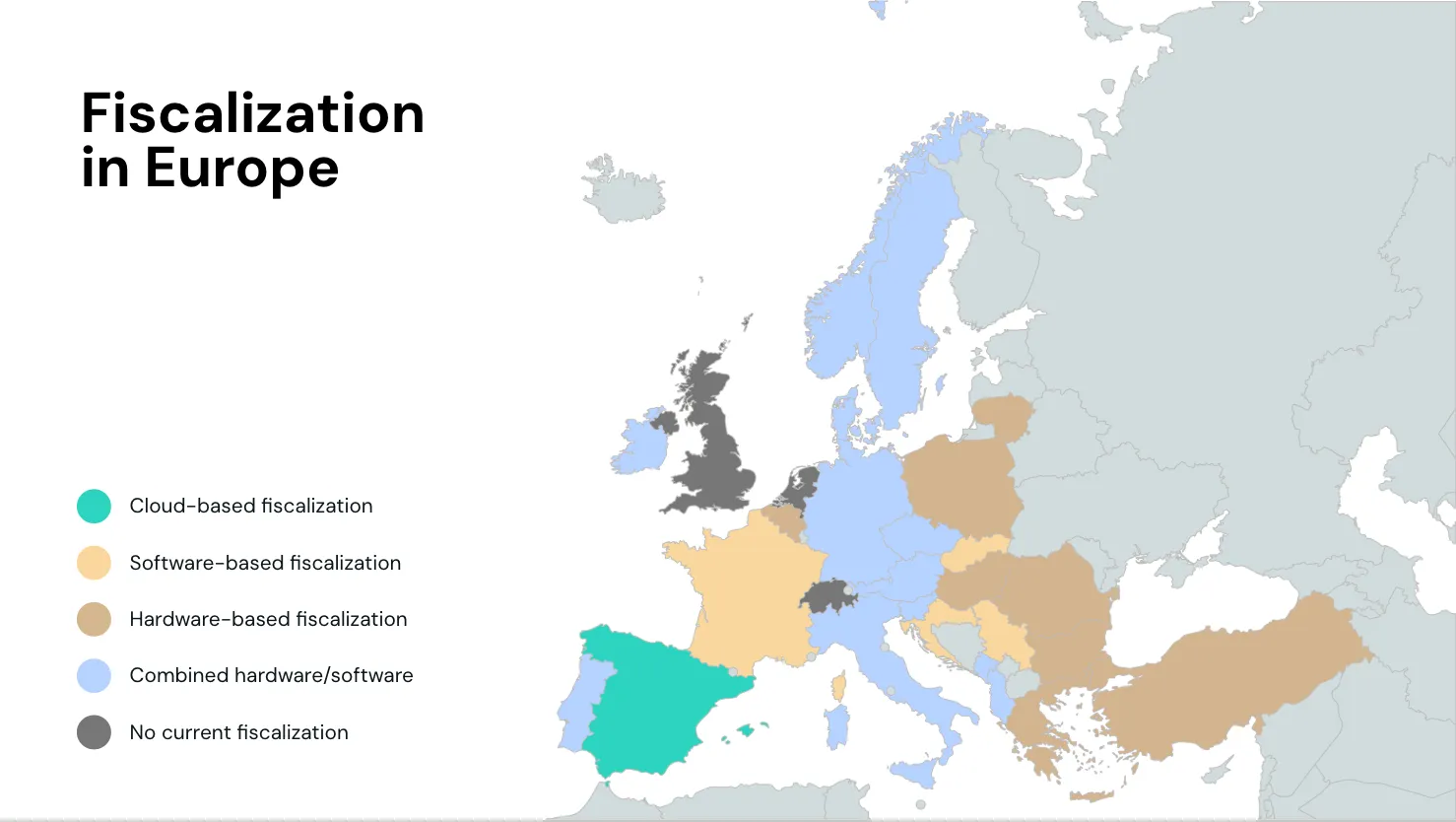

What does fiscalization look like in Europe?

Europe’s fiscalization requirements vary significantly from country to country, reflecting diverse legal frameworks, technical infrastructures, and enforcement approaches.

Depending on country-specific regulations, fiscalization solutions can be

- hardware-based, such as tamper-proof cash registers or certified telematic devices,

- or software-based, involving cloud solutions or certified applications.

Hardware-based approaches often require physical devices to be installed at the point of sale, while software-based systems leverage (cloud) technology for secure and flexible data transmission.

Countries such as Germany, Italy, or Austria also allow for a combined approach of hardware and software options.

Let’s have a look at the fiscalization frameworks of key European markets, providing a comprehensive overview of their requirements and upcoming changes.

- Germany: Germany introduced its fiscalization system in 2020 through the Kassensicherungsverordnung (Cash Register Security Ordinance, or KassenSichV). The regulation mandates that all cash registers must be equipped with a certified technical security system (TSS).

- Austria: Austria’s fiscalization system was introduced in 2016. The Registrierkassensicherheitsverordnung (Cash Register Security Regulation, or RKSV) relies on digital signatures to secure transaction data and ensure its integrity. It mandates businesses to use tamper-proof cash registers to record all transactions securely.

- Spain: Spain’s fiscalization framework focuses on pure cloud fiscalization, and the fiscal landscape is quite complex, as Spain has five different tax authorities across the country, with various legislations impacting different types of companies.

- Italy: Italy was the first country to adopt fiscal regulations and is currently undergoing a move towards software-based fiscalization.

- France: France has taken a software-centric approach to fiscalization with its 2018 regulation requiring certified cash register systems.

- Sweden: Sweden introduced its fiscalization system in 2010. The framework requires businesses above a turnover threshold to use certified cash registers connected to certified control units, which record and secure transaction data in compliance with the Tax Agency’s regulations.

- Belgium: Belgium introduced its fiscalization system in 2015 for the HoReCa sector to ensure transparent sales reporting. Businesses with on-premise sales above EUR 25,000 must use a certified cash register (GKS) linked to a Fiscal Data Module (FDM) and Virtual Smart Card (VSC).

- Portugal: Fiscalization in Portugal is built on certified software, standardized invoice formats, digital signatures, and structured reporting obligations.